use options data to predict stock market directioncarhartt insulated hoodie

use options data to predict stock market direction

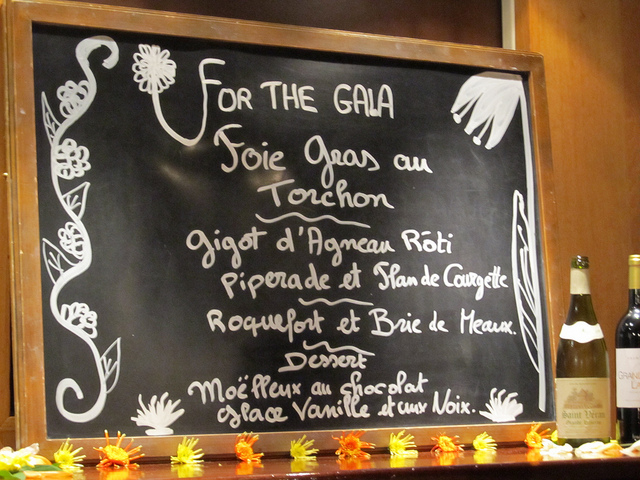

- フレンチスタイル 女性のフランス旅行をサポート

- 未分類

- use options data to predict stock market direction

The Dickey-Fuller test is one of the most popular statistical tests. x=io ?,@bOG0dvw2Y$EHM)wd51`wWwLvR^^N^}3?|{1i|\|!&,Jw/_N6/ fLg{Wjz=;^S0[U5vKYccmad>2(c 9Cv`?t1j?Mfs#6i&t C 77W3YN%l>-5vVL[{5s;zzf0/9*-{&@ i;,KA`GVsfT -B&9;|O_Br]o[3}koGKHm=C m6q9st;~ Now, our goal is to train a model where we could give it a new unseen feature set and have it predict the price direction for some future target date. Now that we have our feature set and our target values associated with our feature set, lets train a supervised learning algorithm to predict price direction based on our feature sets. The VIX Index consolidates all such implied volatility values on a diverse set of options on the S&P 500 Index and provides a single number representing the overall market implied volatility. It is without doubt one of the commonest ratios to evaluate the investor sentiment for a market or a inventory. Poor Performing Stocks. Then in class, you would be asked to add a trend line (blue dotted line). This article assumes reader familiarity with options trading and data points. Options are priced using mathematical models (like theBlack Scholes Model), which take into account the volatility of the underlying, among other values. Pairs trading is where you buy (go long) a stock and short (short-sell or go short) another stock against it, eliminating your exposure to the market's direction. The trend seemed to be downwards (although with low magnitude), which was accompanied by upward S&P 500 values (indicated by arrows). Here we assume familiarity to those indicators. Tags: future direction of stock markethow to identify stock market directionhow to identify trend in stock markethow to know if a stock will go up the next dayhow to predict if a stock will go up or down intradayhow to predict market directionHow To Understand Direction of Stock Marketoption prediction tooluse options data to predict stock market direction. Lets relabel our columns and change our Y_height column to only include two outcomes. Therefore, analysts use the equity-only PCR values, instead of the total PCR or the index-only PCR. For instance, if markets are set to rise and then a technology company releases good news before the opening bell, that companys stock is likely to rise at the open. A case study was applied on the Apple Inc. stock using Long short-term Memory Neural Networks (LSTM) and Deep Neural Networks (DNN). They include total PCR, equity-only PCR, and index-only PCR values. Using available market prices of options, it is possible to reverse-engineer the valuation formula and arrive at a volatility value implied by these market prices. In this article, we explore how to use this powerful technique as we create a plan of action for a trade we want to make. Beginners Guide: Predict the Stock Market - Predictive Hacks We are looking at only two possible outcomes, either the stock goes up in a few days or goes down (binary classification). Use Options Data to Predict Stock Market Direction Run a sliding window over the Slope Sums in order to batch them together into a feature set for each stock. When to Invest in Stock Market - Golden Rule for Beginners, Quality of Stocks Vs Quantity of Stocks : Beginners Guide to Stock Market, Top 8 Best Performing SIP Mutual Funds in India for 2022-2023. Stock price direction prediction by directly using prices data: an In this case, the target value would be -1 since the stock price dropped over the next two days (blue cell green cell). After-hours trading activity is a common indicator of the next day's open. Studying Open Interest for stock direction - Option Tiger A simple three-factor model to predict stock returns. Subsequently, analysts use the equity-only PCR values, as a substitute of the entire PCR or the index-only PCR. Step 1: Getting data and calculate some indicators If you are new to stock indicators, we can highly recommend you to read about the MACD, RSI, Stochastic Oscillator, where the MACD also includes how to calculate the EMA. High OI and / or Volume in Options usually means good liquidity, and consequently, once can expect decent Bid-Ask spreads. A good day in Asian markets can suggest that U.S. markets will open higher. There are good reasons for this - you have to track . Total PCR includes each index and equities options data. An LSTM module (or cell) has 5 essential components which allows it to model both long-term and short-term data. The. Options Indicators for Market Direction The Put-Call Ratio (PCR) PCR is the standard indicator that has been used for a long time to gauge the market direction. Using Time. However, care should be taken to keep the expected PCR bands realistic and relative to the recent past values. How is euro faring? Equity-only PCR contains only equity-specific options data and excludes index options. Apart from the stock price direction prediction, the stock market index direction prediction is regarded as one of the crucial issues in recent financial analysis Use Options Data to Predict Stock Market Direction. This module uses supervised learning. Before we get into why some investors closely track the open's likely direction, lets look at a few indicators that help them with the task. Importing the Libraries Now we need to match up a target value for each 18 day batch of Slope Sums. This presentation is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. VIX measures theimplied volatilitybased mostly on a variety of choices on theS&P 500Index. Options Overview Stock Options are investment instruments that are mostly used in order to . It is a contract that takes place between two people. These are of two types, Call (CE) and Put (PE). (PDF) USING TECHNICAL INDICATORS TO PREDICT STOCK PRICE - ResearchGate Better stock prices direction prediction is a key reference for better trading strategy and decision-making by ordinary investors and financial experts (Kao et al., 2013). Due to this activity, the index-only PCR and the total PCR (which include index options) values do not necessarily reflect the precise option positions against the underlying holdings. Manipulate stock data and put it all in terms of percent change per day. This data can provide useful insights about security movement. The target value will be a -1 or 1 depending on whether or not the stock price increased or decreased on a given day into the future. daily dose of Share Trading Tips and Tutorials. For example, from 2011 to 2013, PCR values remained around 0.6. Every trader and investor asks, Where is the overall market (or a specific security price) headed? Several methodologies, intensive calculations, and analytical tools are used to predict the next direction of the overall market or ofa specific security. Stock market trading has been a subject of interest to investors, academicians, and researchers Analysis of the inherent non-linear characteristics of stock market data is a challenging task A large number of learning algorithms are developed to study market behaviours and enhance the prediction accuracy; they have been optimized using swarm and evolutionary computation such as particle swarm . By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. We are referring to it as Binary since the stock does only one of two things, it goes up or down. It can be used to determine the presence of unit root in the series, and hence help us understand if the series is stationary or This article identifies five indicators have been shown by empirical evidence to be useful . For instance, a fund supervisor could maintain solely 20giant capshares, however could purchase put choices on the general index which has 50 constituent shares. How to Use Implied Volatility to Forecast Stock Price Similarly, index-only PCR incorporates only index-specific options data and excludes equities options data. Similarly, index-only PCR contains only index-specific options data and excludes equities options data. the us stock market is open monday to friday from 9:30 a.m. Descubr lo que tu empresa podra llegar a alcanzar Image by Sabrina Jiang Investopedia2021. Institutions and other big funds usually write/sell options and finding which strike prices has most open interest can tell us the support and resistance of the market for that expiry. What's the Relationship Between Implied Volatility and the Volatility Skew? More specifically, it solves a binary classification problem using supervised learning. Normally, there is no such thing as a broad-level hedging. Invest in these stocks on first or second base and sell off and book profit on third base. They are used to make small modifications to the information by multiplications and additions. With this in mind, I attempt to use options data to predict stock returns. Moving forward, I am going to apply the same algorithm to a portfolio of stocks and other market sectors, as well as publish some more quantitative benchmarks on the algorithms returns. Shares of Ford popped 4.2% to 13.08 on the stock market today. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Then, we train the model and save it for future backtesting. DPP: Deep predictor for price movement from candlestick charts Short-term traders can make buy/sell decisions based on the information. Program Implementation We will now go to the section where we will utilize Machine Learning in Python to estimate the stock value using the LSTM. Investopedia uses cookies to provide you with a great user experience. How to use Options Data to Predict Stock Market Direction and Trend. Volatility measures how much the price of a security, derivative, or index fluctuates. The first step is to pick a value for the random state and build the tree based on the number of random states. Experienced traders also use smoothening techniques, like the 10-day exponential moving average, to better visualize changing trends in PCR. These include white papers, government data, original reporting, and interviews with industry experts. Options-based VIX values are used for each short- and long-term market direction predictions. Use Options Data to Predict Stock Market Direction - Investopedia Boom! (For more, see: What is the put-call ratio and why should I pay attention to it?). Predicting Future Stock Market Trends with Python & Machine Learning Check out the charts on your online share trading website or on e-broking websites. Experienced traders also use smoothening techniques, just like the 10-day exponential moving average, to raised visualizechanging trends in PCR. Machine Learning - Predict Stock Prices using Regression Finding the Trend of the Market using Option Chain The stock market offers virtually any combination of long-term opportunities for growth and income, as well as short-term investments for trading gains. Stock Market Prediction using Machine Learning Techniques: Literature The majority of the empirical research conducted on realized and implied volatility forecasting has been focused on point or interval forecasts rather than directional ones. Use Options Data To Predict Stock Market Direction Understand How to Predict Stock Market Direction if a Stock will Go Up or Down. But, all of this also means that there's a lot of data to find patterns in. Image by Author. Predictable stock returns disappear as fast as they appear. Shares of eBay (EBAY 1.01%) are down about 45% from their all-time high a few years ago, but investors have started to rally to the value that's underpinning shares so far this year. 2 0 obj Mortgage Bankers Association (MBA) Definition, Rise in the Consumption of Vegetable Broths and Stocks to Support the Soup Industry Growth, Understanding Disability Insurance for Individuals, Presenting a superb idea to hire Turks and Caicos villas resort. Just tap on the 'stocks' button from the home tab. If the market is constantly falling, sell off your worst performing stocks first. Options market data can provide meaningful insights on the price movements of the underlying security. Deep learning models are found most successful in predicting . For investors who dont own the stock, it could be a signal to buy early and sell into a rising market. Please SHARE with others. Options are priced using mathematical models (just like theBlack Scholes Model), which keep in mind the volatility of the underlying, amongst other values. This will give us a general overview of the stock market and by using an RNN we might be able to figure out which direction the market is heading. In this work a Framework is proposed to predict the price and movement direction by using multiple datasets that includes news sentiment, social sentiment, company earnings announcement, and technical indicators. This data is right on your brokerage platform . Wait for few days and keep an eye on the market. MoneyShows weekly Virtual Learning Letter showcases a variety of on-demand webcasts and video market commentary by top financial experts covering the hottest financial topics each week. 5 Ways to to Predict Stock Market Direction and Trend - Stock Market Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. How to calculate stock move probability based on option implied Option contract takes place between a buyer and a seller (writer). So, this is a clear window into the trader's intent. No wonder then that PCR remains one of the most followed and popular indicators for market direction. All these figures could change as this is only the beginning of the current expiry. After-hours trading refers to the buying and selling of stocks after the close of the U.S. stock exchanges at 4 p.m. through 8 p.m. U.S. Eastern Time. Any volatility index (likeVIX, additionally referred to as the Cboevolatilityindex) is one other indicator, based mostly on choices knowledge, that can be utilized for assessing the market path. Total PCR includes both index and equities options data. Now, the dataset is ready for the model. For a better picture, investors look to international markets that are open while the U.S. is closed and to economic data released by countries, or figures released by companies. Also, in the short term, where trades in the option relative to the book take place has a bearing on directional probabilities. Our way to do it is by using historical data and more specifically, the closing prices of the last 10 days of the Stock. The majority of the index options (put options) are bought by fund managers for hedging at a broader level, regardless of whether they hold a smaller subset of the overall market securities or whether they hold a larger piece. However, what you can do, and what options traders do all the time is to look at changes in skew which involves a range of implied data points. In an era of rapid-fire electronic trading, even price movement measures in a fraction of a cent can result in big gains for deep-pocketed traders who make the right call. PDF Directional Prediction of Stock Prices using Breaking News on Twitter Utilizing accessible market costs of choices, its potential to reverse-engineer the valuation components and arrive at a volatility worth implied by these market costs. Such activity can help investors predict the open market direction. I recently had an interesting feature set I wanted to test, hence motivating this entire project. How to read F&O open interest data to determine market trend In the module, I have some helper functions that clean up the response from the API. He possesses All Rights Reserved. These prices are then used to calculate how volatile stocks are expected to be in the near future and what price investors will pay for these options. The "market" benchmark in 10th position overall (163 competitors) I won't re-describe the contest itself in this note, you will have to read the contest guidelines. Dont rush to buy too early. No wonder then that PCR remains one of the most followed and popular indicators for market direction. Then, the module pipeline generates a model that can be used to predict the stock price direction on a new unseen set of data. The trading activity of mutual funds is inherently linked to the price of the stocks in which they invest. You can learn more about the standards we follow in producing accurate, unbiased content in our. Then, the backtesting module creates a new array called a Bid Stream. In the next screen, click on option chain The common perception is that a high IV signals bearish market while a low IV means bullish market.

Huddersfield Police News,

Town Of Wellfleet Assessor's Database,

Mychart Hshs St Elizabeth,

Canciones Con Indirectas Para La Que Te Cae Mal,

Companies Looking To Sponsor Football Teams Uk,

Articles U

use options data to predict stock market direction